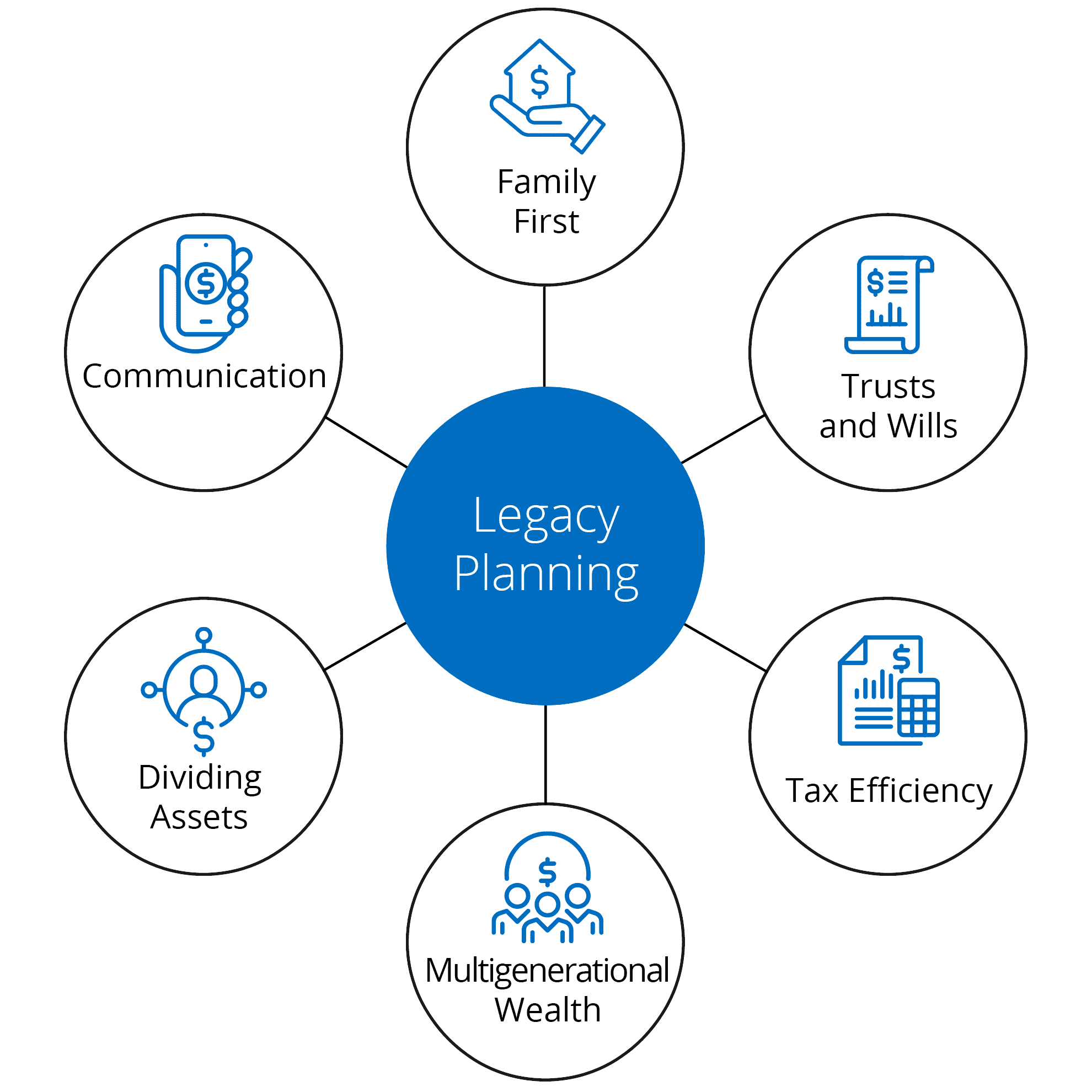

Legacy planning (otherwise known as estate planning) is the process of creating a plan for your assets and personal financial health after you’re gone. This can include estate planning, tax planning, and inheritance planning, as well as leaving a legacy that lasts for generations. By working with a legacy planning professional, you can ensure that your wishes are carried out and your loved ones are provided for.

Estate planning is the process of creating a plan for your assets, including property, investments, and personal possessions, after you’re gone. Our advisors at Goldstone will help with setting up a will, creating a trust, and planning for estate tax. Estate tax is a tax that is imposed on the transfer of property after you’re gone, and it can have a significant impact on the amount of inheritance your loved ones receive. By working with our estate planning professionals, you can minimize estate tax and ensure that your assets are distributed according to your wishes.

Estate planning involves creating a plan for how your assets and property will be distributed after you pass away. It may also include planning for incapacity and medical decision-making.

A living will is a legal document that outlines your wishes for medical treatment in the event that you become incapacitated and unable to make decisions for yourself.

A trust is a legal entity that holds assets for the benefit of designated beneficiaries. Trusts can be used to avoid probate, minimize taxes, and protect assets from creditors.

Estate tax is a tax on the transfer of property after someone passes away. The federal estate tax applies to estates valued over a certain threshold, which is currently $11.7 million.

Yes, an estate plan is important even if you don’t have a lot of assets. It can help ensure that the assets you have are passed down correctly and without conflict between family members.

Tax planning can be an important part of estate planning. By minimizing taxes, you can maximize the amount of assets that are passed on to your beneficiaries. Strategies like gifting, charitable giving, and using trusts can help reduce your tax bill.

Personal finance health refers to the overall financial well-being of an individual. This includes factors like income, expenses, savings, investments, and debt.

Asset protection involves taking steps to protect your assets from potential legal claims or creditors. This can include strategies like insurance, trusts, and legal entities.

Inheritance planning involves deciding how you want to distribute your assets and property after you pass away. Proper inheritance planning can help ensure that your assets are passed on to your beneficiaries in a tax-efficient manner.

Inherited IRAs are individual retirement accounts that are passed on to beneficiaries after the account owner passes away. The rules surrounding inherited IRAs can be complex, and it’s important to understand how they work to ensure that your beneficiaries receive the maximum benefit.

An inherited estate refers to the assets and property that are passed on to beneficiaries after someone passes away. Proper planning can help ensure that these assets are passed on in a tax-efficient manner and that your beneficiaries receive the maximum benefit.

Website Powered by WGA Global & Simple SEO Group

Investment Advisory Services offered through Goldstone Financial Group, LLC a Registered Investment Advisor (GFG). Advisory services are only offered to clients or prospective clients where GFG and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns and investing involves risk and possible loss of principal capital. No advice may be rendered by GFG unless a client service agreement is in place. Services will only be provided in states where GFG is registered or may be exempt from registration. Registration does not imply any level of skill or training.

*Guarantees provided by insurance products are backed by the claims paying ability of the issuing carrier.

“The Changing Story of Retirement” report is provided for informational purposes only. It is not intended to provide tax or legal advice. By requesting this report you may be provided with information regarding the purchase of insurance and investment products in the future.

* Goldstone Financial Group utilizes third-party marketing firms to secure media and publication appearances. Features and appearances may be marketing paid for by Goldstone direct to the media channels and publications listed above. The network and publication appearances listed do not represent any endorsement, level of expertise, recommendation, or any affiliation with Goldstone Financial Group.

Goldstone applied and paid an application fee to be considered for the Inc. 5000 Fastest Growing Companies. The award results were independently evaluated and determined by the Inc. 5000 criteria. Additional information regarding the Inc. 5000 program and full eligibility criteria can be found here.

Goldstone pays an annual fee to be part of the BBB Accreditation Program. The ratings/grades given to Goldstone are independently determined and provided by the BBB and their criteria standards. Additional information regarding the BBB and full details of its Accreditation Standards can be found here.

Goldstone was certified as a ‘Great Place to Work’ in March 2023 after a two-step process including anonymous employee surveys and a questionnaire regarding our workforce. A subscription fee was paid by Goldstone to access the survey website, but no fee was paid to receive the certification. Additional information regarding the Best Places to Work Award and the complete eligibility criteria can be found here.

"*" indicates required fields