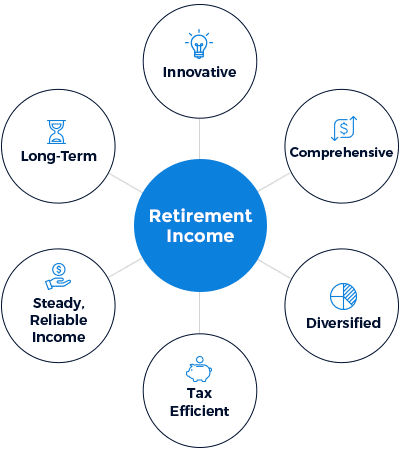

Planning for retirement is a critical endeavor that requires careful consideration and strategic action. Given the complexities of today’s financial landscape, a comprehensive plan is essential to ensure a steady income stream and protect and grow assets. Goldstone Financial Group specializes in crafting personalized retirement strategies that address these needs, giving clients the confidence to enjoy their golden years without financial uncertainty.

Understanding Retirement Planning

Retirement planning involves preparing for a future where your employment income ceases, and you rely on accumulated savings, investments, and other income sources to maintain your current lifestyle. A robust retirement savings plan considers various factors, including income replacement, asset growth, tax efficiency, and healthcare costs. Goldstone Financial Group offers services tailored to these objectives, ensuring each client’s needs and goals are met.

Income Planning: Ensuring a Reliable Income Stream

One of retirees’ primary concerns is ensuring a consistent and reliable income throughout retirement. Goldstone’s Lifetime Income Planning services focus on financial stability strategies, allowing clients to cover their expenses and enjoy their retirement years.

Social Security Optimization

Maximizing Social Security benefits is a crucial component of retirement income planning. Goldstone’s advisors analyze your work history, earnings, and oGoldstone’sming strategies to ensure you receive the maximum benefits. Understanding the nuances of Social Security rules helps you make informed decisions about when and how to claim your benefits.

Annuities and Pension Planning

Goldstone provides guidance on selecting the best options to secure guaranteed income for those with pensions or considering annuities. They assess the stability of pension plans and the suitability of various annuity products, aligning them with your overall retirement goals. This approach ensures a dependable income source complements other retirement assets.

Investment Income Strategies

Diversifying income sources, including real estate and low-cost, diversified index funds, is vital for financial security in retirement. Goldstone’s Security develops investment strategies that generate income through interest pGoldstone’sd systematic withdrawals. Balancing growth and income-producing investments helps maintain your purchasing power while providing the funds needed for daily expenses.

Asset Protection and Growth: Safeguarding Your Nest Egg

Protecting and growing your assets during retirement is essential to counteract inflation, market volatility, and unforeseen expenses. Goldstone Financial Group’s Asset Protection Planning services are designed to shield your wealth from potential risks while you pursue the Group’s opportunities.

Diversification and Risk Management

A well-diversified portfolio reduces reliance on any single asset class or market sector. Goldstone’s advisors assess your risk tolerance and investment horizon to create a balanced portfolio that aligns with Goldstone’s retirement objectives, recommending investing more money upfront where necessary. Regular portfolio reviews and adjustments ensure that your investments align with changing market conditions and personal circumstances.

Tax-Efficient Investment Strategies

Minimizing tax liabilities is crucial for preserving wealth. Goldstone employs strategies such as tax-loss harvesting, asset location optimization, and utilization of tax-advantaged accounts to enhance after-tax returns. Integrating tax planning with investment management helps you retain more of your hard-earned money.

Estate Planning and Legacy Preservation

Careful estate planning ensures that your assets are distributed according to your wishes. Goldstone collaborates with legal professionals to establish wills, trusts, and beneficiary designations that reflect your intentions. This comprehensive approach preserves your legacy and minimizes potential estate taxes and legal complications for your heirs.

Healthcare and Long-Term Care Planning

Healthcare costs can be a significant burden in retirement. Goldstone’s planning services include evaluating options for health care insurance, Medicare, and long-term care coverage. By anticipating these expenses and integrating them into your retirement plan, they help protect your assets from being depleted by medical costs, allowing you to enjoy more free time during retirement.

The Goldstone Retirement Roadmap

Goldstone Financial Group’s approach to retirement planning is encapsulated in our Retirement Roadmap, a personalized strategy that guides you through each retirement phase. Group’soadmap includes:

- Discovery Phase: Understanding your financial situation, goals, and concerns.

- Planning Phase: Develop a customized plan that addresses income needs, investment strategies, tax considerations, and estate planning.

- Implementation Phase: Executing the plan focusing on transparency and client education.

- Monitoring Phase: Regularly reviewing and adjusting the plan to adapt to life changes and market conditions.

Why Choose Goldstone Financial Group?

With over two decades of experience, Goldstone Financial Group has established itself as a trusted partner in retirement planning. Their team of fiduciary advisors is committed to acting in your best interest, providing unbiased advice tailored to your unique circumstances. By offering comprehensive services encompassing all aspects of retirement planning, they ensure you have a cohesive and effective strategy for securing your financial future.

Conclusion

Navigating tax planning for 2025 requires expertise and proactive strategies. By working with Goldstone Financial Group, you can reduce tax liabilities and build long-term financial security.

Don’t wait for tax laws to change—schedule a consultation today and develop a tailored tax strategy with our experts.