Personalized Financial Planning in Elmhurst

Our approach to financial planning in Elmhurst is built around your life, not a one-size-fits-all model. We’ll help you understand where you stand today, and how to move toward your goals tomorrow. We focus on practical strategies that are easy to follow and flexible enough to adjust as your life changes.

From building an emergency fund to long-term investing, estate strategies or insurance planning, our team is here to support you with knowledge and perspective. Working with a financial advisor in Elmhurst gives you access to resources and insights that can help you feel more in control of your future.

Retirement Planning in Elmhurst You Can Rely On

One of the most important areas we support is retirement planning in Elmhurst. Retirement is about more than leaving work behind. It’s about living life on your terms, without the stress of financial uncertainty. That’s why we help you create a retirement strategy that is focused, realistic, and aligned with your lifestyle goals.

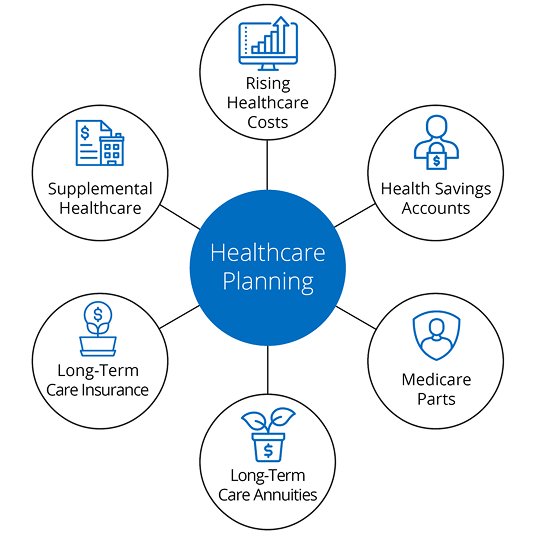

We walk you through every detail from income projections and Social Security timing to managing withdrawals and healthcare costs. With a long-term approach to retirement planning in Elmhurst, you’ll be able to take meaningful steps toward a future you can enjoy.

Elmhurst Retirement Planning Built Around You

Retirement should be something you look forward to with confidence. Our personalized support makes the process less overwhelming and more manageable. With the help of a trusted financial advisor in Elmhurst, you can build a retirement plan that is rooted in your priorities, and flexible enough to adapt along the way.

We believe the best results come from consistent communication and a clear plan. That’s why our approach to retirement planning in Elmhurst focuses on transparency, education, and careful decision-making at every stage.

Why Goldstone is the Right Fit for Elmhurst Residents

Goldstone Financial Group has become a trusted name in financial planning in Elmhurst because we put people first. Our team brings years of experience and a personal commitment to each conversation. We treat your financial goals as our own, and we offer guidance that’s grounded in both industry expertise and human understanding.

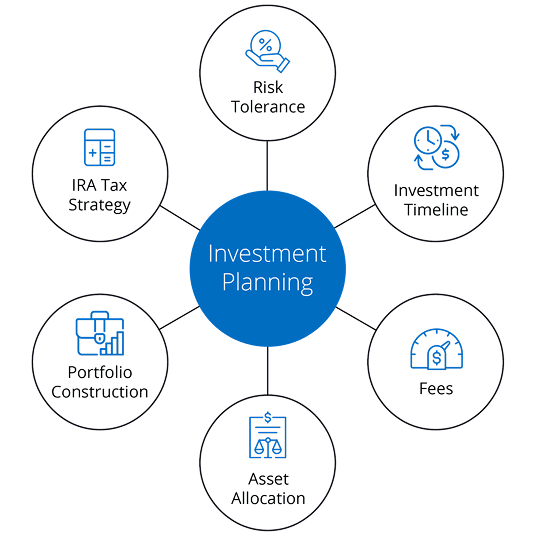

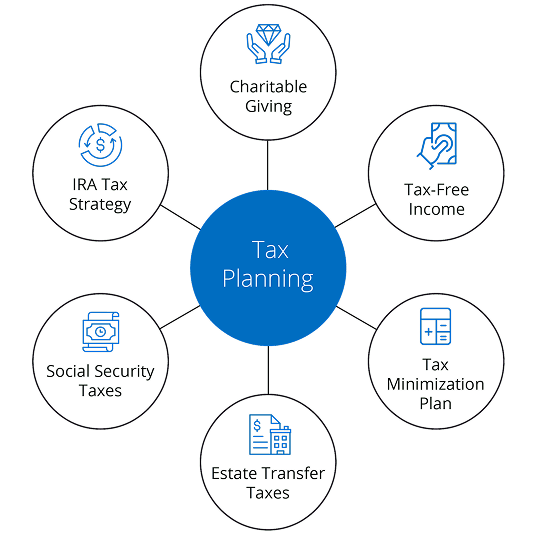

Our services go far beyond basic investment advice. We help with tax planning, insurance reviews, estate strategies, and more. Working with a skillful financial advisor in Elmhurst means you’re never alone in making important decisions about your financial life.

Let’s Build Your Future Together in Elmhurst

You deserve a financial strategy that reflects who you are and where you want to go. At Goldstone Financial Group, we’re here to help you build it. Connect with a local financial advisor in Elmhurst today to start your personalized plan.