Expert Insights on Effective Tax Planning Strategies

You're missing out if you don't have a complete investment plan.

Let's talk and make sure you're making every dollar work for you.

Effective tax planning is key to good financial management. By knowing your financial situation and using smart tax planning methods, you can lower your tax bill and improve your tax situation with organized tax records. This means you can use more money to reach your financial goals. This guide will share helpful tips on strong tax planning strategies. These strategies will help you make better financial choices.

Understanding the Basics of Tax Planning

Tax planning is about managing the timing of income and your money wisely to reduce your tax bills within the law. Instead of waiting for tax season to deal with your taxes, good tax planning helps people and businesses look ahead to future taxes. It also allows them to use smart methods to save money all year.

This means knowing your tax bracket, using deductions and credits to your advantage, and finding investment options that save you money on taxes. The main goal is to keep more of the money you earn by lowering extra tax costs.

The Importance of Knowing Your Tax Bracket

Your tax bracket is based on how much you earn each year. This affects how much tax you pay. In the United States, there is a tiered tax system. This means those who earn more money will pay a bigger percentage of their income in taxes.

It is important to know your tax bracket for good tax planning. This knowledge affects your choices. For example, if you expect a large rise in ordinary income, knowing your tax bracket can help you decide whether to maximize deductions or postpone some income. To check your withholding, you can use the IRS withholding estimator, which can help you handle possible tax issues ahead of time.

When you understand how tax brackets work, you can make better financial choices during the year. This will help you manage your tax liability effectively.

Deductions vs. Credits: Maximizing Your Returns

Deductions and credits are important in tax planning. They can make a big difference in your tax return. Deductions lower your taxable income, which means you pay less tax. For example, itemized deductions, such as mortgage interest or medical expenses, let you subtract certain costs from your income before figuring out your tax bill, forming the basis for your overall tax strategy.

Tax credits, on the other hand, reduce the actual amount of tax you pay for a maximum refund and can affect your overall tax rate. A tax credit, like the Child Tax Credit or Earned Income Tax Credit, gives you a direct cut in your tax bill. For instance, a $1,000 tax credit means you pay $1,000 less in tax.

It’s important to know which deductions and credits you can use to save the most money on taxes. Talking to a tax professional can help you understand how to make the best use of these options based on your financial situation.

Strategic Contributions to Retirement Accounts

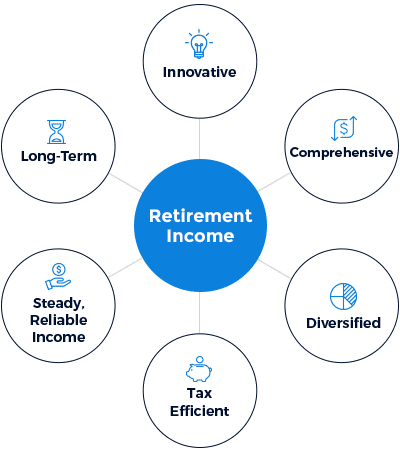

Making smart choices for retirement accounts is very important. They help you save for the future and give you good tax benefits. Knowing how these accounts work and putting in more money can really help with your tax planning.

You can enjoy immediate tax benefits from traditional IRAs and 401(k)s. Or, with Roth IRAs, you can take out money tax-free later. It is important to connect your retirement savings to your long-term money goals and your comfort level with risk. This will help you create a good retirement plan.

Benefits of Maxing Out Your 401(k) or IRA Contributions

Maximizing what you put into your 401(k) or IRA for the tax year can really help with your taxes. If you contribute the most you can for that calendar year, you may lower your taxable income. This might mean you pay less tax overall. This approach not only helps you build savings for retirement but also lets your investments grow without being taxed right away. Plus, by adding money to these accounts, you can lower your current tax bill and create a better long-term financial plan. It can be a good idea to talk to a financial advisor to make the most of these tax-efficient strategies.

Roth IRA Conversions: A Tactical Move for Tax Savings

Roth IRA conversions can help you manage the taxes you pay during retirement. Unlike traditional IRAs, where you pay taxes on withdrawals, Roth IRA withdrawals can be tax-free if you meet certain conditions.

Moving money from a traditional IRA to a Roth IRA can be a smart choice if you think you will be in a higher tax bracket when you retire. You will pay taxes when you make the switch, but your future withdrawals will be tax-free. This could save you a lot of money on taxes over time.

Still, it is very important to talk to a financial advisor. They can help you think about your current financial situation, your future income, and your overall retirement plan before you decide to convert to a Roth IRA.

Investment Strategies for Tax Efficiency

Investing wisely means you need to understand more than just profits. You also need to know how taxes affect different types of investments and strategies. Using tax-efficient methods can really boost your returns after taxes.

Strategies like tax-loss harvesting or keeping your investments longer can help you pay lower capital gains taxes. These strategies are important for getting the most out of your investments and reducing extra tax costs.

Utilizing Tax-Loss Harvesting to Offset Capital Gains

Tax-loss harvesting is a smart way to manage your investments. It involves selling investments that are losing money to balance out the money you made on other investments. This can help lower how much tax you have to pay at the end of the year.

Here’s how it works: When you sell an investment for a profit, you make a capital gain. This gain is taxable. But if you have capital losses from other sales, you can use those to reduce your capital gains. This means you pay less tax.

This method can be very helpful in a shaky market. It lets you manage your tax bill while still following your investment plan. It’s a good idea to talk to a financial advisor or tax professional. They can help you understand tax-loss harvesting and whether it’s good for your portfolio.

Smart Gifting: Leveraging the Annual Exclusion

Smart gifting strategies can help you with your tax planning. They can lower your taxable estate and may cut down on future estate taxes. A key part of this strategy is using the annual gift tax exclusion.

This exclusion lets you give a specific dollar amount to as many people as you want without paying gift taxes. In 2023, you can give $15,000 to each person (for single filers). By gifting within this limit each year, you can slowly take wealth out of your estate. This also lowers its taxable value over time.

However, gift tax rules can be tricky. It is important to talk to a financial advisor or estate planning attorney. They can help you understand the rules and use gifting strategies in the best way.

Optimizing Deductions and Credits

To lower your tax bill, you should make the most of your tax deductions and credits. By knowing the different types of deductions and credits you can use, you can plan your taxes better. This help can reduce the amount you owe.

You can claim deductions for things like charitable donations and medical expenses. You can also earn credits for education and energy savings. By looking into all your options, you can make sure you are not paying too much in taxes. This way, you keep more of your income.

Itemizing Deductions Over Standard Deductions

Choosing between itemized and standard deductions is an important step in tax planning. Itemizing deductions lets taxpayers subtract specific costs that go beyond a certain percentage of their adjusted gross income (AGI). This can help lower their taxable income.

Some common itemized deductions are medical and dental expenses, state and local taxes, property taxes, mortgage interest, and donations to charity. Taxpayers need to find out if their itemized deductions are greater than the standard deduction for their filing status to see which option is best.

Whether to itemize or to take the standard deduction depends on personal situations. It is wise to discuss this choice with a tax expert to make sure of the best tax outcome.

Conclusion

Effective tax planning is very important for managing your money. To save more, you should know your tax bracket. Make sure to use all deductions and credits. Also, think about how to invest for retirement. Using smart strategies, like tax-loss harvesting and giving gifts wisely, can help improve your financial situation. If you want to decrease your taxable income or use tax benefits, it is best to plan ahead. People with high incomes might gain from looking into Roth IRA conversions and careful retirement account contributions. By following these tips, you can build a tax plan that fits your financial goals. Want to save more on taxes? Talk to our experts today.