Dedicated Financial Planning in Glendale

We believe that effective financial planning in Glendale should be comprehensive, intentional, and forward thinking. At Goldstone, our planning process considers your full financial picture, from cash flow to retirement income to legacy preservation.

Our team stays informed about financial markets, tax changes, and planning trends so your strategy can grow along with your goals. With a trusted financial planner in Glendale, you can make decisions today that support the future you want.

Retirement Planning in Glendale You Can Rely On

Retirement should feel like an exciting new chapter, because it is! If you’re just starting to plan or already preparing to make the leap, we’re here to help you create a retirement plan that fits your life. As specialists in retirement planning in Glendale, we work with you to build a strategy that supports a comfortable and rewarding future.

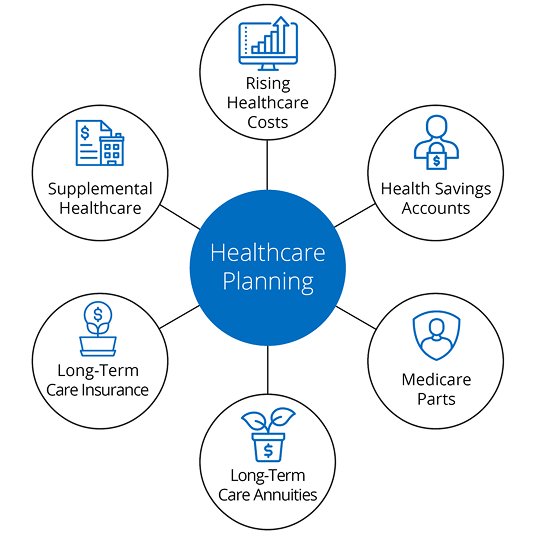

We’ll help you make sense of income planning, Social Security, healthcare costs, and other important pieces of the retirement puzzle. A dedicated financial advisor in Glendale will help you shape a plan that reflects your lifestyle and your priorities.

Real Planning for the Glendale Retirement You Want

Planning for retirement here in Glendale is a big step, and it requires way more than guesswork. Our experienced retirement planners in Glendale help you understand all the moving parts like taxes, inflation, required distributions, and more, so you’re prepared for what’s ahead. Every decision you make impacts your tomorrow, and we’re here to help you make the right ones.

With a dedicated retirement planner in Glendale, you’ll receive personalized support, insightful guidance, and a customized roadmap for long-term security.

Why Glendale Chooses Goldstone Financial Group

Goldstone Financial Group offers a full spectrum of services, but it all starts with a relationship built on trust. When you partner with a financial planner in Glendale, you gain access to a team of professionals who are fully dedicated to your financial well-being. We don’t offer any one-size-fits-all solutions, every single plan is built around your goals, your challenges, and your vision for the future.

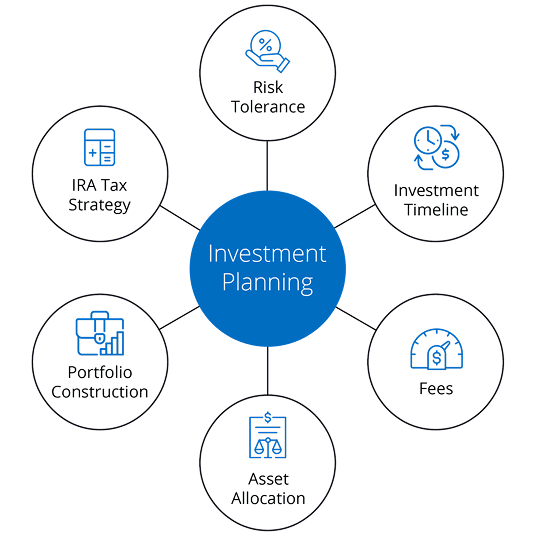

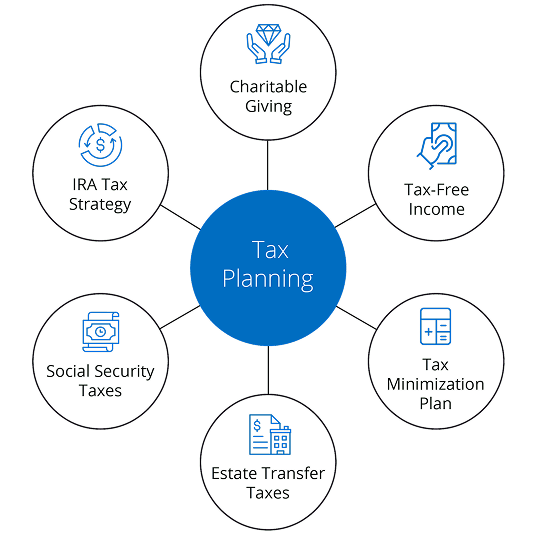

Our financial services in Glendale include:

- Investment management

- Long-term financial planning in Milwaukee

- Personalized retirement income strategies

- Risk management and insurance

- Estate and legacy planning

- Charitable giving and education funding

Whether you need a retirement planner to help you transition into the next phase of life, or a financial planner in Glendale to guide your wealth-building journey, we’re here to walk beside you every step of the way.

Let’s Secure Your Financial Future Here in Glendale

At Goldstone, we believe that everyone deserves the peace of mind that comes from having your finances in order. Our commitment to personalized service and proactive planning sets us apart as a top choice for anyone seeking a financial advisor or a retirement planner in Glendale.

Let’s build a plan that reflects your goals, values, and future vision. Contact us today to connect with a retirement advisor in Glendale who understands what matters most to you.