Finding the right health insurance and health plan is essential to ensuring you have access to the care you need when you need it. Our healthcare planning services include guidance on health insurance and health plans.

We’ll help you understand your options, including Medicare and private insurance plans, and help you choose the plan that best meets your needs and budget. We’ll also provide you with resources and support to help you navigate the often-confusing world of health insurance and make informed decisions.

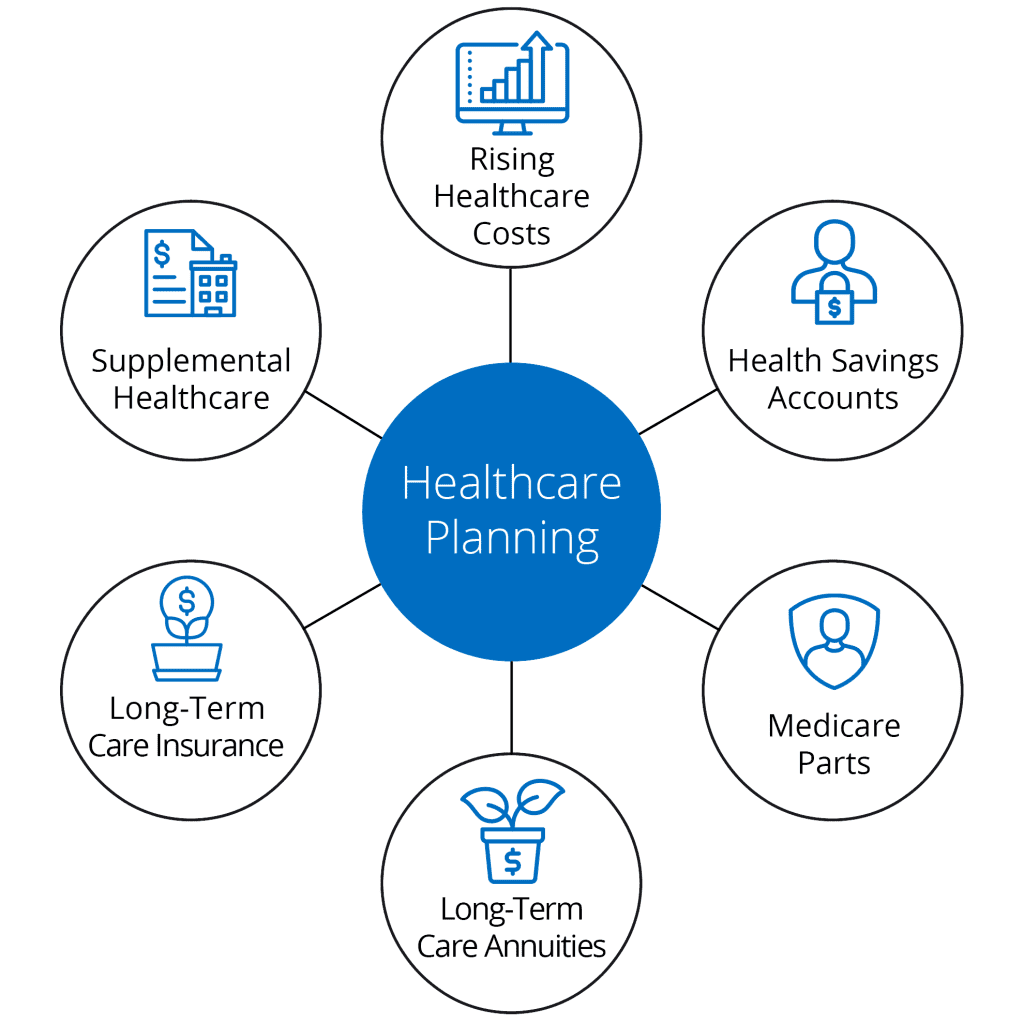

Healthcare planning is the process of planning and preparing for your future healthcare needs. This includes assessing your current health status, developing a plan for maintaining and improving your health, and planning for long-term care and end-of-life care.

Anyone nearing or in retirement can benefit from healthcare planning services. Whether you’re in good health or have health concerns, healthcare planning can help you prepare for your future healthcare needs and ensure you have access to the care you need when you need it.

Healthcare planning involves a comprehensive assessment of your current health status and future health goals. It includes developing a personalized healthcare plan that takes into account your unique needs and preferences, as well as guidance on long-term care options, advanced care planning, disability planning, and health insurance and health plans.

Healthcare planning can help you develop and maintain a healthy lifestyle by providing guidance and support on healthy eating, physical activity, and stress management. It can also help you prepare for the possibility of a disability or chronic illness, and ensure you have access to the care you need when you need it.

Website Powered by Simple SEO Group

Investment Advisory Services offered through Goldstone Financial Group, LLC a Registered Investment Advisor (GFG).

*Guarantees provided by insurance products are backed by the claims paying ability of the issuing carrier.

“The Changing Story of Retirement” report is provided for informational purposes only. It is not intended to provide tax or legal advice. By requesting this report you may be provided with information regarding the purchase of insurance and investment products in the future.

* The network and publication appearances listed do not represent any endorsement, level of expertise, recommendation, or any affiliation with Goldstone Financial Group.

Goldstone applied and paid an application fee to be considered for the Inc. 5000 Fastest Growing Companies. The award results were independently evaluated and determined by the Inc. 5000 criteria. Additional information regarding the Inc. 5000 program and full eligibility criteria can be found here.

Goldstone pays an annual fee to be part of the BBB Accreditation Program. The ratings/grades given to Goldstone are independently determined and provided by the BBB and their criteria standards. Additional information regarding the BBB and full details of its Accreditation Standards can be found here.

Goldstone was certified as a ‘Great Place to Work’ in March 2023 after a two-step process including anonymous employee surveys and a questionnaire regarding our workforce. A subscription fee was paid by Goldstone to access the survey website, but no fee was paid to receive the certification. Additional information regarding the Best Places to Work Award and the complete eligibility criteria can be found here.

"*" indicates required fields