Build a Strong Financial Future with a Professional Investment Planner

Retirement is a time in life that many people look forward to. After decades of working hard, you finally get to enjoy the fruits of your labor and pursue your passions. However, in order to enjoy your retirement to the fullest, it’s important to have a solid investment plan in place. This can help ensure that you have enough money to support yourself and your loved ones throughout your golden years. The investment planner at Goldstone Financial Group will help you explore the ins and outs of investment planning for retirement, including retirement plans, investment strategies, asset management, and more.

Choosing the Right Investment Plan for Your Needs

One of the first steps in investment planning for retirement is choosing the right retirement plan. There are several options to choose from, including 401(k) plans, individual retirement accounts (IRAs), and Roth IRAs. Each plan has its own set of rules and requirements, so it’s important to do your research and choose the plan that best fits your needs.

A 401(k) plan is an employer-sponsored investment plan that allows you to contribute a portion of your pre-tax income to the plan. Many employers also offer matching contributions, which can help boost your savings even further. One advantage of a 401(k) plan is that your contributions are deducted from your income before taxes are taken out, which can help reduce your taxable income.

IRAs and Roth IRAs, on the other hand, are individual retirement accounts that you can open on your own. Traditional IRAs allow you to contribute pre-tax dollars, while Roth IRAs use after-tax dollars. Both types of accounts offer tax advantages, but the rules for withdrawals and contributions vary between the two.

Regardless of which investment plan you choose, it’s important to contribute as much as you can afford to. The more you save now, the more you’ll have in retirement.

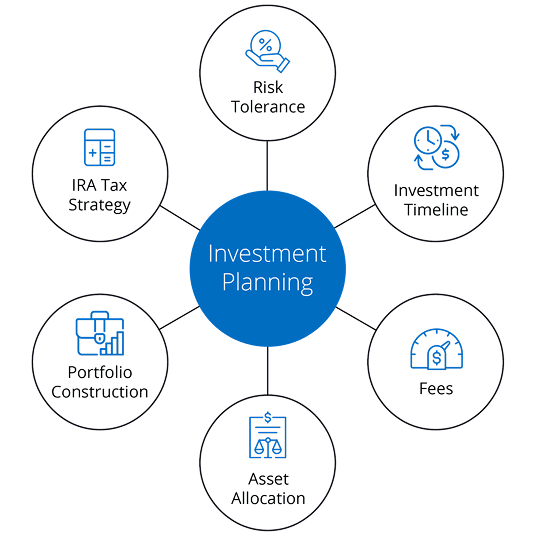

Investment Planning: Finding the Right Mix

Another key aspect of investment planning is investment allocation. This refers to the process of dividing your portfolio among different asset classes to minimize risk and maximize returns. The right investment allocation mix will depend on your risk tolerance, financial goals, and time horizon.

Generally speaking, younger investors with a longer time horizon can afford to take on more risk, since they have more time to recover from any losses. Older investors, on the other hand, may want to focus on more conservative investments that offer stability and income.

Building a Diversified Investment Plan

Once you have a investment plan in place, the next step is to develop an investment strategy with a diversified portfolio. A good investment strategy should be based on your long-term goals, risk tolerance, and time horizon. It should also take into account the different asset classes and investment vehicles available.

Asset classes refer to different types of investments, such as stocks, bonds, real estate, and commodities. Each asset class has its own level of risk and return potential, so it’s important to diversify your portfolio across multiple asset classes.

Investments can be managed actively or passively. Active management involves selecting individual stocks and bonds based on market trends and other factors. Passive management, on the other hand, involves investing in index funds or other funds that track a particular market index. Both strategies have their pros and cons, so it’s important to weigh the risks and rewards of each.

Investment Planners Balancing Short and Long-Term Investments

In order to reach your investment goals, it’s important to balance your investments between short and long-term investments. Short-term investments, such as money market funds or certificates of deposit (CDs), offer lower returns but also lower risk. Long-term investments, such as stocks and mutual funds, offer higher returns but also higher risk.

The key is to find the right balance between the two types of investments. Once again, this will depend on your risk tolerance, financial goals, and time horizon. As a general rule of thumb, you may want to allocate a larger percentage of your portfolio to long-term investments if you have a longer time horizon, and a larger percentage to short-term investments if you are nearing retirement.

Mutual Funds and Index Funds

Mutual funds and index funds are popular investment vehicles for investment planners. Mutual funds are professionally managed portfolios of stocks, bonds, or other securities. They offer diversification and the opportunity for higher returns, but they also come with management fees and other expenses. Index funds, on the other hand, are designed to track a particular market index, such as the S&P 500. They are passively managed and typically have lower fees than actively managed mutual funds. While they may not offer the same potential for high returns as some mutual funds, they can be a good option for investors who want to minimize expenses and simplify their investment strategy.

Investment planning for retirement is a complex process that requires careful consideration of your financial goals, risk tolerance, and time horizon. By choosing the right retirement plan, developing a solid investment strategy, and staying disciplined over the long-term, you can help ensure that you have the financial resources you need to enjoy a comfortable retirement. Whether you prefer mutual funds, index funds, or other investment vehicles, the key is to stay focused on your long-term goals and to make smart investment decisions along the way.