Comprehensive Services to Meet Your Financial Needs

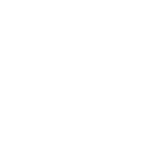

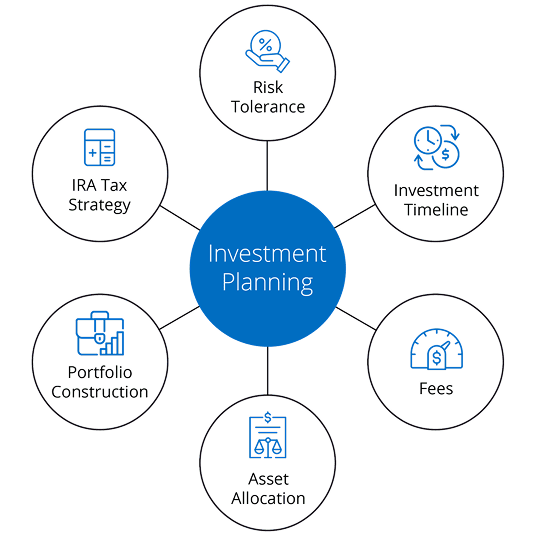

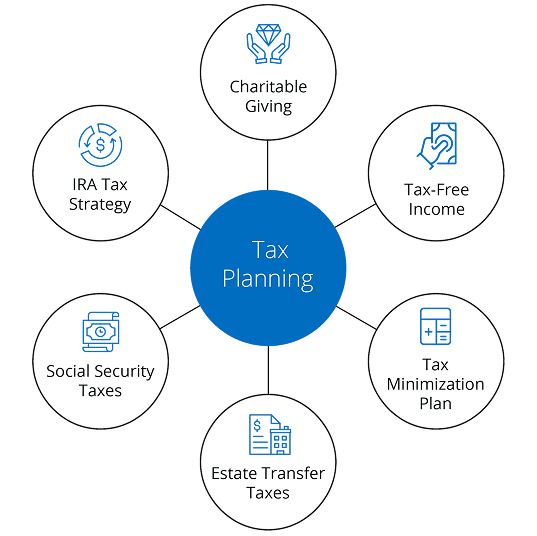

Our extensive range of financial services is designed to address every facet of your financial life. Our knowledgeable staff possesses the expertise to provide the guidance and support necessary for informed financial decisions across the spectrum. Our services encompass retirement planning, investment management, estate planning, tax strategies, insurance solutions, and business succession planning.

Trusted Advisors for Cincinnati’s Financial Success

At Goldstone Financial Group, we place a premium on trust and integrity within our client relationships. We are dedicated to fostering enduring partnerships based on transparency, accountability, and exceptional service. Our advisors dedicate time to comprehending your goals and concerns, delivering clear and straightforward advice to help you navigate the intricate financial landscape.

Take Control of Your Financial Future here in Ohio

Your financial prosperity and security rank foremost among our priorities. Allow Goldstone Financial Group to be your dependable partner on the journey toward realizing your financial objectives in Chicago’s Fulton Market. Reach out to us today to arrange a consultation and explore how our expertise can illuminate the path to a more promising financial future.