The Goldstone Retirement Process

At Goldstone Financial Group, we have a process for building a financial strategy that gives you a firm foundation for pursuing your goals. We’ll provide a tactful and comprehensive financial strategy just for you.

Discover

Schedule a meeting to sit down with us and discover what your ideal retirement looks like.

Evaluate

Using our Goldstone Retirement Roadmap, we’ll examine your current financial situation and determine your retirement income needs.

Plan

Receive a custom strategy designed to help you reach your unique retirement goals.

Results Driven Financial Planning

Our experienced team of professionals will help ensure you receive top-tier service with a plan tailored to your retirement goals. Our team works diligently to help you feel confident knowing our plan will not only get you retired, but stay retired.

Schedule a Call

Income Planning

Our goal is to help ensure your expenses are paid with reliability & predictability for the rest of your life.

- Social Security maximization

- Income and expense analysis

- Inflation, spousal and longevity plan

- Retirement income strategies

- Annuities

- IRA rollovers

- 401(k) rollovers (from current and previous employers)

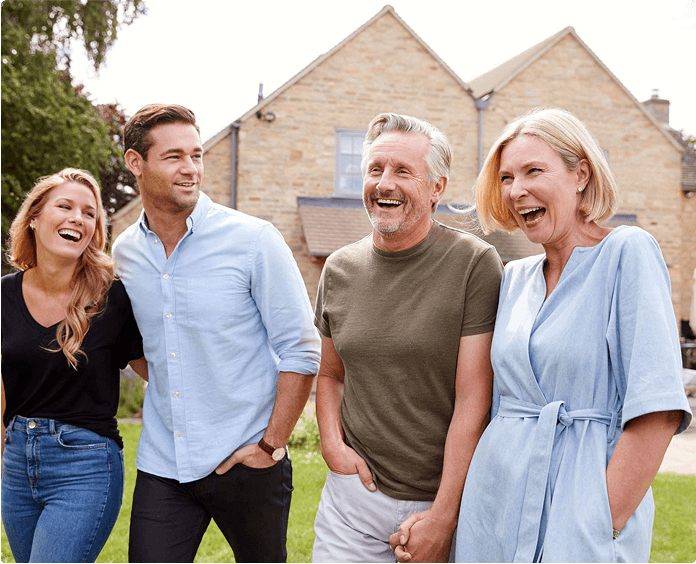

Investment Planning

We’ll talk risk tolerance, portfolio fees (and how we may be able to reduce them), volatility control and our comprehensive money management approach.

- Market volatility protection

- Assessing your risk tolerance

- Adjusting your portfolio to reduce fees wherever possible

- Wealth management

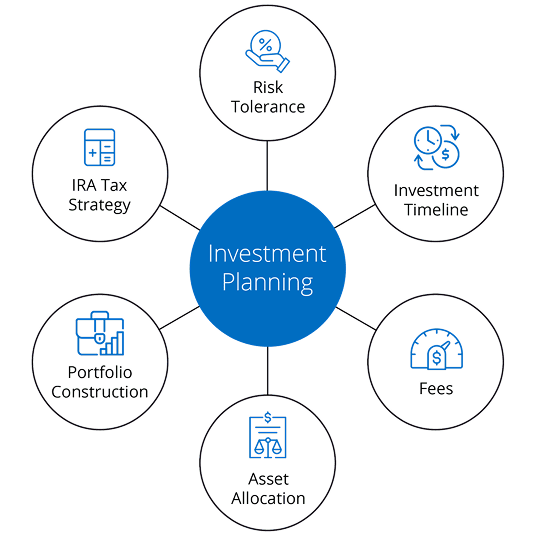

Tax Planning

We’ll look at the taxable nature of your current assets and potential ways to include tax-deferred or tax-free money in your financial plan.

- Strategizing ways to include tax-deferred or tax-free money in your plan

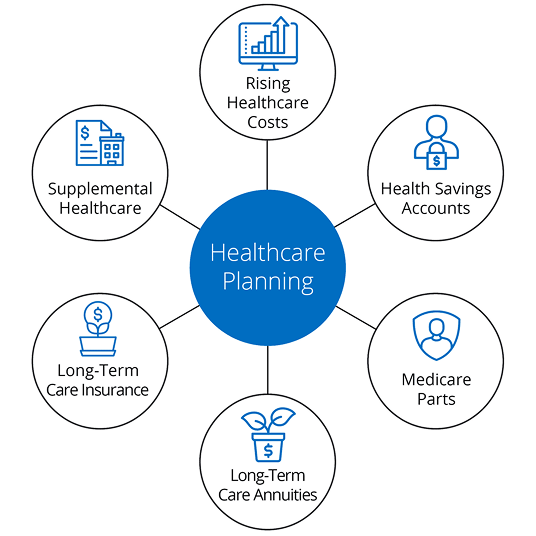

Healthcare Planning

We’ll look at Medicare, Parts A, B and D, and long-term care options in order to address rising Healthcare costs.

- Long-term care strategies

- Life insurance

- Plan for protecting against climbing Healthcare costs & long-term care needs

Legacy Planning

Together, with qualified professionals, we’ll create a plan that is designed so your hard-earned assets go to your beneficiaries in the most tax-efficient manner.

- Create a plan to help your beneficiaries reduce or avoid probate

- Maximize opportunities to reduce estate tax burdens

- Trusts

- Charitable giving

- Estate planning