Personalized Financial Planning in Cincinnati

Comprehensive financial planning in Cincinnati isn’t just about managing money. At Goldstone, we work with you to align your finances with you values through personalized plans that account for everything from income to investments to taxes. All of our financial planners in Cincinnati are committed to delivering advice that supports both your current lifestyle and future aspirations.

With holistic strategies and ongoing support, our financial planning in Cincinnati strategies help you make proactive choices with confidence. From saving for a major milestone or protecting your legacy, we provide the clarity you need to move forward.

Retirement Planning in Cincinnati that Reflects Your Goals

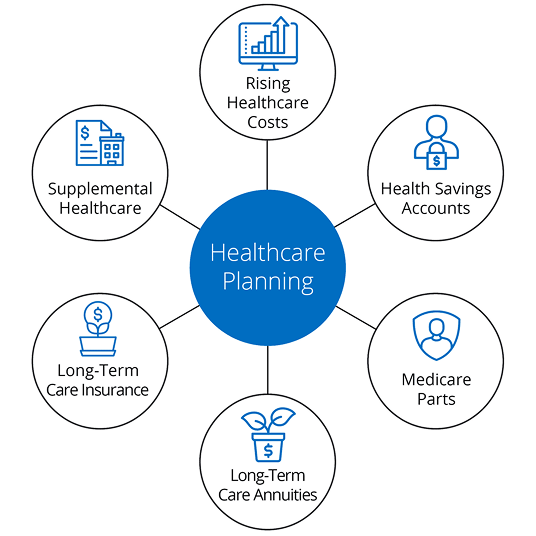

Your retirement should be rewarding, not worrisome. That’s why we offer in-depth retirement planning in Cincinnati designed to give you peace of mind. Our process includes income distribution strategies, tax planning, healthcare preparation, and market risk analysis, so you’ll be able to retire on your own terms.

Retirement planning in Cincinnati through Goldstone means more than just setting some goals. Together, we’ll create a roadmap that adapts to all your life’s changes. From pre-retirement decisions to managing funds in retirement, we’ll be there every step of the way.

Cincinnati Retirement Planning with Purpose

A trusted retirement advisor in Cincinnati can help you protect your wealth and sustain it through retirement and beyond. At Goldstone, our advisors work closely with you to refine your plan, adjust for market fluctuations, and coordinate with your legal and tax professionals.

Choosing a retirement advisor in Cincinnati means gaining a personal advocate who’s dedicated to helping you make informed decisions that serve your long-term interests. From Social Security timing to portfolio withdrawals, we’ll help you approach retirement with clarity and confidence.

Full-Service Financial Planning for Cincinnati Residents

While many clients some to us for retirement planning in Cincinnati, they stay because of the holistic financial care that we provide. Our services include:

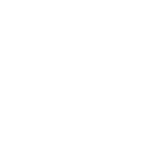

- Wealth and investment management

- Comprehensive financial planning

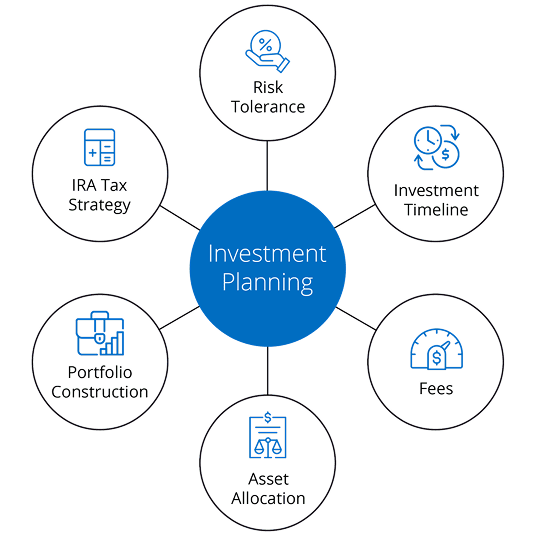

- Tax-efficient income strategies

- Insurance and risk protection

- Estate and legacy planning

- Education savings and charitable giving

When you work with a financial planner in Cincinnati, you gain access to a team that sees how each piece of your financial puzzle fits together. We’re here to help you make smart decisions today that lead you to a stronger tomorrow.

Let’s Build Your Future Together Here in Cincinnati

Your financial goals deserve the attention of a team that truly cares. At Goldstone Financial Group, we combine experience with a deeply personal approach to deliver tailored solutions for each and every client.

Connect with a financial advisor in Cincinnati today and take the first step toward building a future filled with possibility. From financial planning to long-term retirement planning in Cincinnati, we’re here to help you create a plan that you can believe in.