Your Dedicated Financial Planner in Dayton

At Goldstone, we believe successful planning starts with meaningful relationships. Our financial planners in Dayton are committed to helping you define your financial vision, set achievable goals, and create a realistic path toward them. From planning a family to growing a business to getting ready to retire, we offer expert advice and reliable strategies for every milestone.

When you work with a Goldstone financial advisor in Dayton, you gain a long-term partner who is invested in your success and will work with you to see it through.

Retirement Planning Dayton Residents Trust

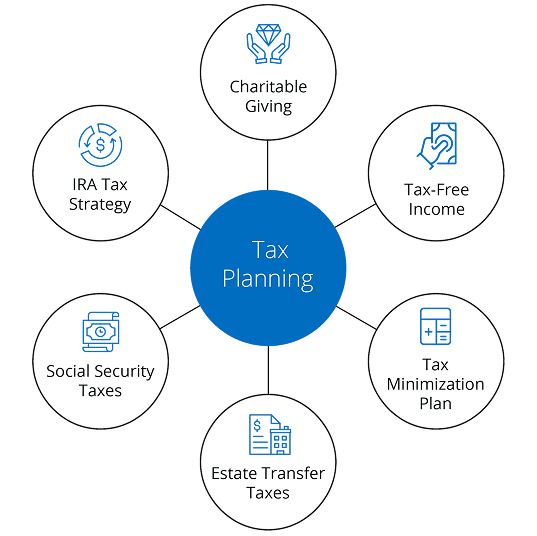

Retirement should bring peace of mind and a sense of accomplishment. Whether you’re decades away or fast approaching your target date, our team specializes in helping you prepare. With our hands-on approach to retirement planning in Dayton, we focus on creating a sustainable income strategy, managing healthcare coasts, and optimizing your Social Security benefits.

As your personal retirement advisor in Dayton, we’ll work to make sure that your plan supports the lifestyle you envision. We know that retirement is about more than just numbers and we’re here to give you the quality of life, freedom, and legacy that you’re looking for.

Expert Retirement Planners in Dayton

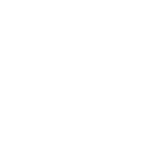

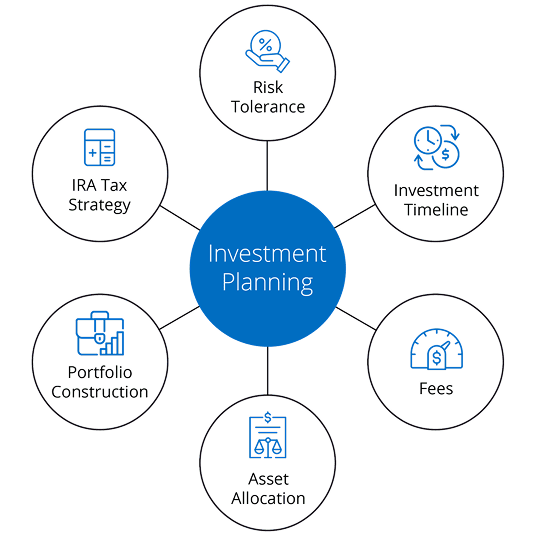

Planning for retirement here in Dayton is a big step, and it requires way more than guesswork. Our experienced retirement planners in Dayton help you understand all the moving parts like taxes, inflation, required distributions, and more, so you’re prepared for what’s ahead. Every decision you make impacts your tomorrow, and we’re here to help you make the right ones.

With a dedicated retirement planner in Dayton, you’ll receive personalized support, insightful guidance, and a customized roadmap for long-term security.

Why Dayton Chooses Goldstone Financial Group

Clients across Dayton choose Goldstone because our advice comes with understanding, dependability, and real results. Our team brings decades of experience in financial planning in Dayton, retirement strategy, tax optimization, and investment management. We listen closely and plan carefully, so every detail supports your bigger picture.

Whether you’re working with a financial advisor in Dayton for the first time or refining a lifelong strategy, we’re ready to help you take the next step with confidence.

Let’s Secure Your Financial Future Here in Dayton

You don’t have to navigate your financial journey alone. Connect with a professional financial planner in Dayton today and discover the Goldstone difference. We’re here to help you build, protect, and enjoy your wealth today and in all the years to come. The future you want starts with the right plan. Let’s build it together.