Retirement Planning Oak Brook Can Trust

Retirement is not just a savings goal, it’s a stage in your life that you should look forward to. At Goldstone, retirement planning in Oak Brook is tailored to you. We focus not only on what you need to retire, but how you’ll want to live once that goal is reached.

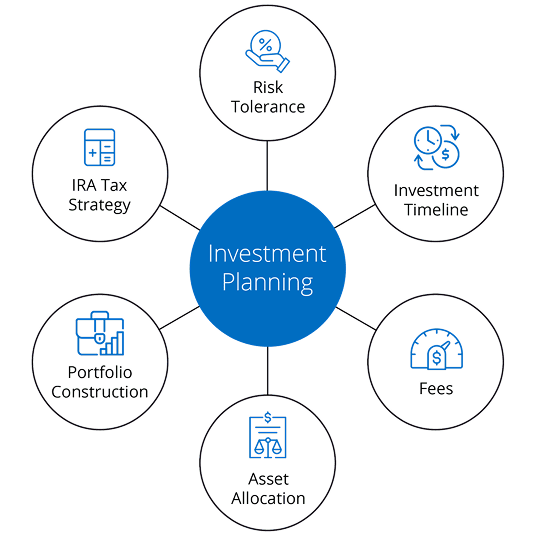

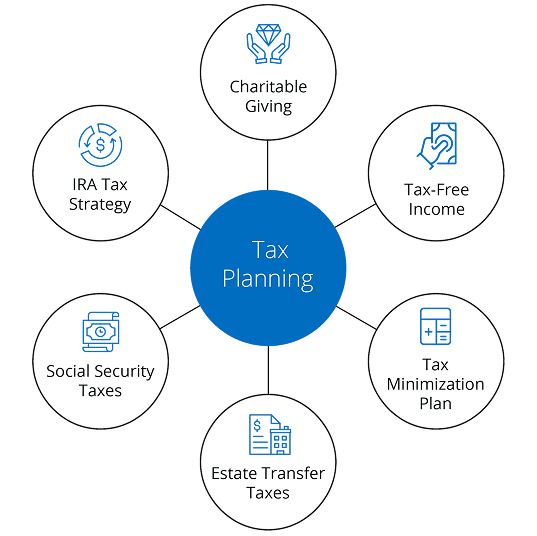

From income distribution strategies to Social Security optimization, healthcare expenses, and tax-efficient distributions, we help you tackle the real-world decisions that create a comfortable retirement.

With the right financial planner in Oak Brook, your retirement plan is no longer a guess; it’s a vision you can trust.

Work With an Oak Brook Financial Advisor

Finding the right financial advisor is a question of working with somebody who actually understands what you are attempting to achieve. Our team provides experience, empathy, and a commitment to making your goals succeed.

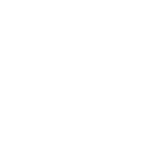

Our financial advisors in Oak Brook offer personalized investment planning, wealth management for the long term, risk and insurance planning, retirement income planning, estate and legacy planning, tax-efficient planning, and education/life-event funding. At Goldstone, you are not viewed as a client, but a partner.

Let's Talk About Your Financial Future in Oak Brook

There is no perfect time to begin planning, but many reasons to begin today. Whether you are looking for immediate change or on a long term mission, an Oak Brook financial planner can help you move forward with confidence. At Goldstone, we’re here to inform your path with knowledgeable advice and personalized planning, every step of the way.

Our team is dedicated to supporting you through every financial decision, ensuring your Oak Brook financial planning can adapt as you experience changes in your life or priorities. We provide ongoing updates allowing you to remain confident that your financial future will be secure no matter what life throws at you.