Comprehensive Financial Planning Brentwood Residents Can Rely On

Every individual’s financial journey is distinct. That’s why our Brentwood financial planning process is based on your particular situation and changing needs. Whatever your goal is—paying off debt, saving for college, building your investment portfolio—we collaborate with you to build a clear and reliable financial plan. Our financial planners in Brentwood make sure to stay ahead of the game, adjusting your plan to accommodate every change in life so your financial future remains on track. We understand that actual financial planning is never-ending, it is not a single list but a constant process of review, adjustment, and tracking. For this reason, Goldstone offers frequent plan reviews and is always ready to respond to your questions and address new problems as they arise.

Retirement Planning Brentwood That Fits Your Lifestyle

Retirement planning isn’t just numbers, however—retirement planning is building the life you desire to live. At Goldstone, our retirement planning in Brentwood helps you prepare for every aspect of your future.

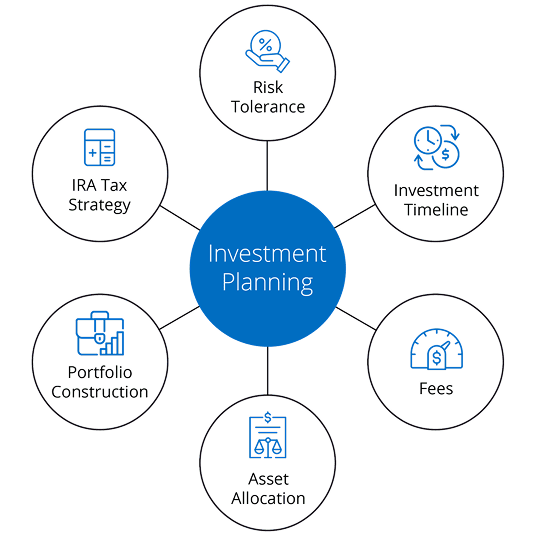

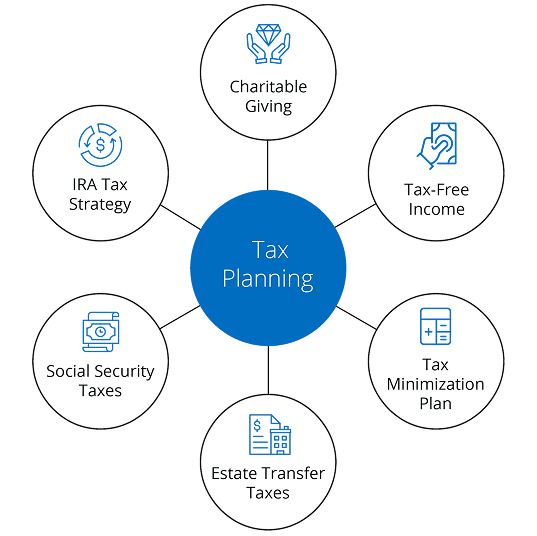

We guide you through Social Security optimization, tax-efficient withdrawal planning, health care cost planning, and more. We want you to feel secure throughout the entire retirement experience no matter how distant that goal may be, from initial planning and saving to actual transition and income management in retirement. Our retirement planners in Brentwood are by your side every step of the way with personalized guidance.

Financial Advisors Brentwood Residents Trust

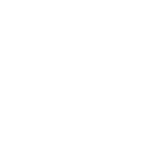

It requires more than qualifications to choose the right financial planner in Brentwood—it takes someone who really knows and cares about your financial goals. Our team offers a full range of services including investment management, estate planning, risk management, and tax-effective management. Regardless of your current situation, Goldstone offers personalized attention guaranteed to keep your money safe and growing.

Start Planning Your Economic Future Today Here in Brentwood

No matter where you are in life, the best time to get started is now. Whether you’re making plans for a major life change or want to amend your existing strategy, a Brentwood financial planner can guide you to move forward with confidence. Contact Goldstone Financial Group today to begin crafting a plan that is right for you.