Clear, Personalized Chicago Financial Planning

At Goldstone, we work hard to simplify the complexities of financial planning. Our approach to retirement planning in Chicago focuses on clarity, transparency, and trust. We work with individuals, families, and business owners across the city to develop plans that address every aspect of your financial life: budgeting, investments, tax strategy, estate planning, and more.

With our customized approach, your financial planner in Chicago will help you move forward with confidence and peace of mind form the very beginning.

Retirement Planning in Chicago Tailored to Your Future

Planning for retirement isn’t just about reaching a number, it’s about preparing for the life you want to live. Our team specializes in retirement planning in Chicago, guiding clients through every phase of the process and answering your questions along the way.

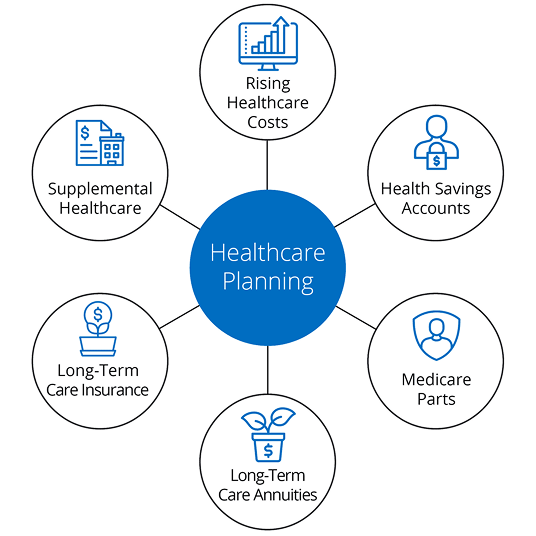

Whether you’re years away or already in retirement, we’re here to help you design a plan that balances your income needs, lifestyle goals, and risk tolerance. Your financial advisor in Chicago will be by your side to create a roadmap that supports your long-term security, from healthcare planning to income distribution.

Have Confidence in Your Chicago Financial Advisor

Life is full of changes, and your financial plan should be designed to evolve with them. That’s why our team offers consistent, proactive support through every season of life. With Goldstone’s approach to financial planning in Chicago, you’re never alone in making key decisions that would affect your financial future.

We believe in empowering our clients with knowledge and direction. With a dependable financial planner in Chicago, you’ll have someone in your corner who genuinely cares about helping you thrive.

Why Choose Goldstone Financial Group Chicago

Chicago residents choose Goldstone for retirement planning because we deliver more than just numbers. We base our experience in delivering trust, integrity, and results to each of our clients with a passion for helping them achieve real-life outcomes.

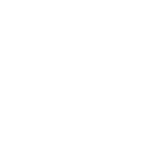

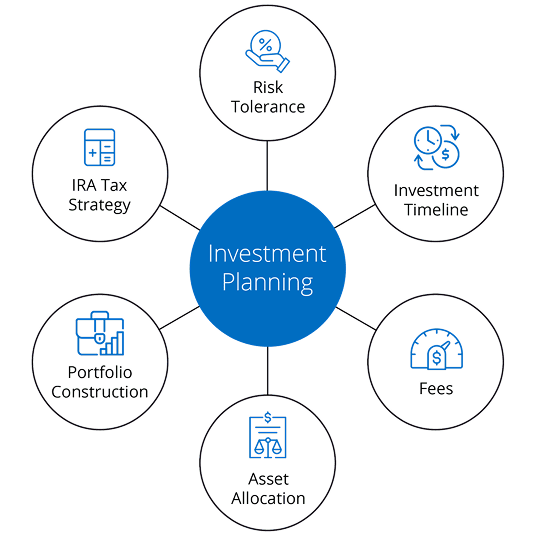

We offer a full suite of services, from investment management and tax planning to insurance and estate strategies. With a comprehensive outlook and a personal approach, your Chicago financial advisor can help you prepare for life’s expected, and unexpected, moments.

Take the First Step Toward a Stronger Financial Future Here in Chicago

You don’t have to figure it all out alone. Connect with Goldstone Financial Group and see how working with a skilled financial planner in Chicago can change the way you plan for the future. Let’s build a strategy that reflects your goals, values, and the life you want to lead.