Comprehensive Services to Meet Your Financial Needs

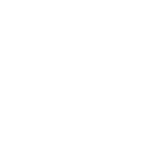

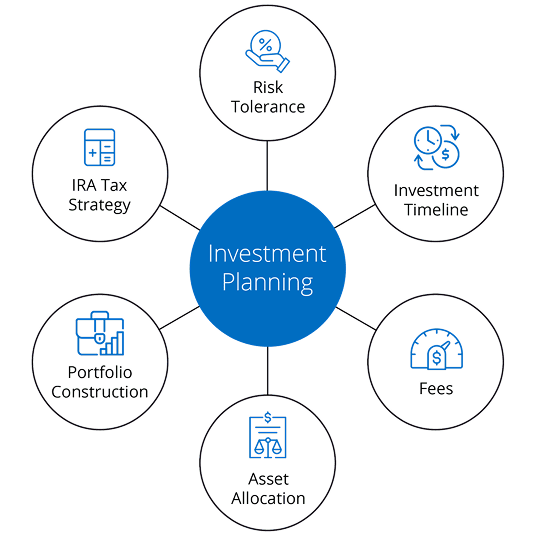

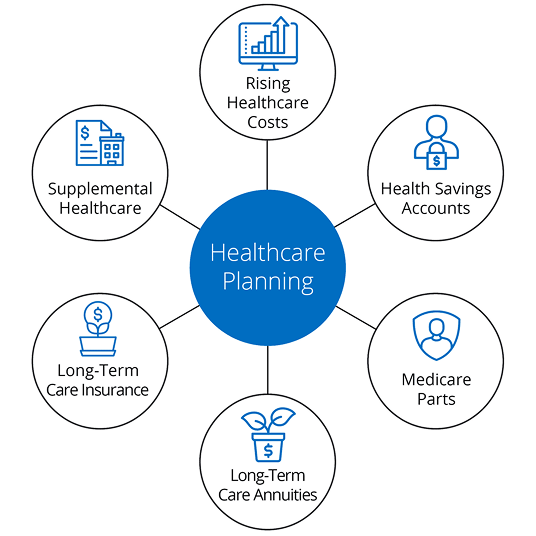

Goldstone Financial Group offers a comprehensive range of financial services designed to address all aspects of your economic life. From retirement planning, investment management, and estate planning to tax strategies, risk management, and business succession planning, our team has the expertise and knowledge to provide you with the guidance and support you need to make informed financial decisions.

Trusted Advisors for Hoffman Estates’ Financial Success

At Goldstone Financial Group, we believe that honesty is the foundation of our client relationships. We prioritize open communication, transparency, and accountability. Our dedicated advisors are committed to building long-term partnerships based on trust, understanding, and exceptional service. We will work closely with you to develop strategies that align with your financial goals and help you navigate the ever-changing financial landscape.

Retirement Planning in Schaumburg & Barrington

Goldstone Financial Group is also proud to serve the surrounding areas of Hoffman Estates, including Schaumburg and Barrington. Whether you’re looking for investment planning services or looking to set yourself up for retirement, trust the financial services experts at Goldstone to help make those dreams come true.

Take Control of Your Financial Future in Hoffman Estates

Your financial success and security are our only priorities. Let Goldstone Financial Group be your trusted partner on the path to achieving your financial goals in Hoffman Estates. Contact us today to schedule a consultation and discover how our expertise can help guide you toward a brighter financial future.