Simplifying Financial Planning in Nashville

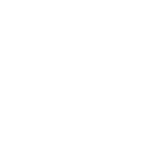

Our mission is to help you feel confident about your finances today and in all the years ahead. That’s why our approach to financial planning in Nashville is designed to be clear, collaborative, and comprehensive. We work with individuals, couples, and business owners to build plans that cover investment strategies, tax optimizations, risk management, and so much more.

You’ll work side-by-side with a dedicated financial planner in Nashville who will explain every step, so you can make informed decisions without feeling overwhelmed.

Nashville Retirement Planning to Reflect Your Lifestyle

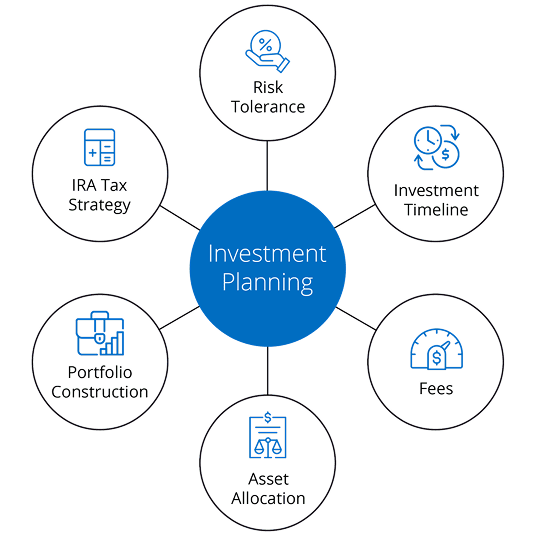

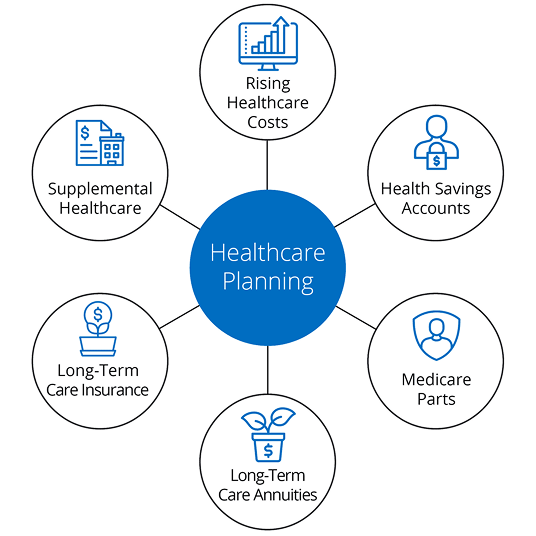

Your retirement goals are personal, and your plan should be too. As a leading retirement planner in Nashville, TN, Goldstone helps clients prepare for the future with smart, strategic retirement plans. From income allocation and tax strategies to long-term care planning and Social Security timing, we make sure every part of your retirement is aligned with your vision.

Our retirement planners in Nashville, TN focus on creating flexible, personalized retirement roadmaps that adjust as your life changes. Whether you have decades to prepare or if your retirement is right around the corner, we’re here to help you feel prepared and in control.

Get Ongoing Support from a Trusted Financial Advisor in Nashville

Financial planning is a lifelong process, not a one-time event, so our financial advisors in Nashville always stay connected with you through every life transition. We monitor your progress, adjust strategies when needed, and help you stay focused on the future that you want.

Our goal is always to empower you with actionable insights and a responsive partnership. When you choose a financial planner in Nashville from Goldstone Financial Group, you get a dedicated professional who is invested in your long-term success.

Why Nashville Clients Choose Goldstone Financial Group

Nashville is known for its heart, its hustle, and its sense of community. At Goldstone, we bring those same values into every client relationship. Our experienced retirement planning team offers a full suite of services, from wealth building to tax strategies to retirement solutions.

Our clients appreciate working with a retirement planner in Nashville, TN who truly understands their lifestyle and offers down-to-earth, practical advice. No matter where you are on your financial path, our Nashville financial advisors are ready to help you move forward with purpose.

Let’s Start Planning Your Future Together Here in Nashville

Your goals deserve attention, your future deserves strategy, and your finances deserve clarity. Goldstone Financial Group is here to offer you all three. Reach out today to connect with a dedicated financial advisor or retirement planner in Nashville, TN and begin building a plan that works for your life now, and in the future.