Northbrook's Financial Advisors

At Goldstone Financial Group, we are dedicated to offering individuals and families in Northbrook financial planning based on real life. Whether it’s saving for the future, retirement planning, or securing protection for the long term, we make each financial decision more understandable and strategic.

We understand that financial planning is not a one-size-fits-all solution. Every person who walks in our door has their own goals, responsibilities, and timeline. That’s why we take each relationship personally. When you work with a Northbrook financial planner, you’ll work with someone who cares, understands your vision, and propels you forward with a plan that really works.

Personalized Financial Planning in Northbrook

Smart financial planning isn’t spreadsheets or forecasts, it’s developing a strategy from where you’re at and where you’re headed. We listen to your whole picture at Goldstone and provide you with recommendations that are thoughtful, relevant, and informative.

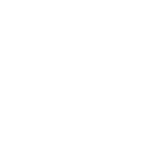

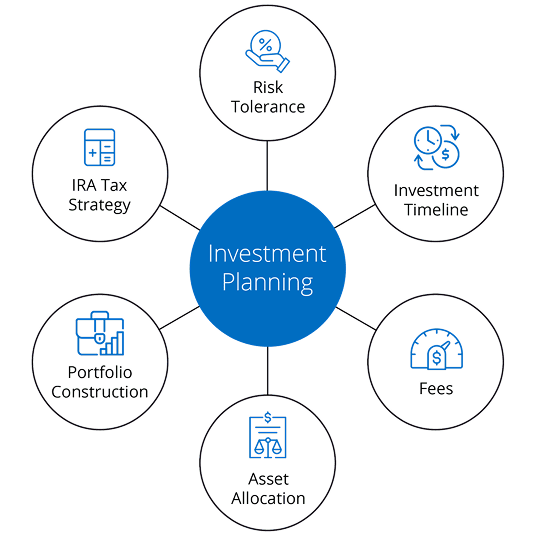

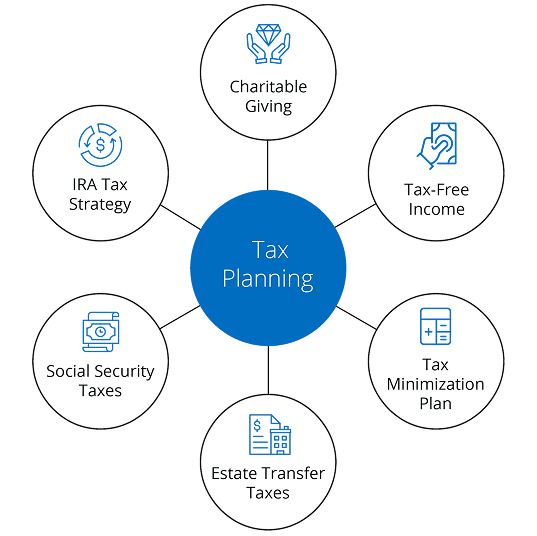

Our Financial planners in Northbrook are focused on your goals. We work with clients who have a wide range of needs, from cash flow and budgeting concerns to building debt payoff plans or long-term savings. Additionally, we offer guidance on investments, college savings, and long-term tax-efficient plans.

Life changes, and your plans often need adjustments. There is a dedicated Northbrook financial advisor ready to help you modify your plan and stay on track with your priorities. Every step is tailored, every conversation is personalized, and every one of our objectives is to help you make improved, stress-free decisions.