Retirement Calculator: Plan Your Financial Future

You're missing out if you don't have a complete investment plan.

Let's talk and make sure you're making every dollar work for you.

Retirement planning is very important for your financial future. Figuring out how much money you will need for a comfortable life after you stop working can be overwhelming. A retirement calculator can really help. It shows you details about your finances. This way, you can make smart choices to reach your retirement goals.

Understanding Retirement Planning in the United States

In the United States, planning for retirement is very important. It helps you keep the lifestyle you want once you stop working. Unlike many other developed countries, the U.S. expects people to take care of their own finances during retirement.

Social Security is a federal program that offers some help, but it usually does not cover all your living costs. So, it is essential to have a complete retirement plan. This plan should include your savings and investments. It is key to having a secure retirement.

The Importance of Early Planning

Early planning is very important to reach your retirement goals. The sooner you start saving and investing, the more time your money has to grow. It’s never too early to think about retirement and set financial goals.

When you start your retirement plan early, you can use compounding. Compounding helps your money make even more money over time. This leads to good growth in the long term. The earlier you start, the more you can accumulate in the future.

Even small and steady contributions can make a big difference over time. Starting early helps you spread out what you contribute. This way, you won’t have to make large contributions later that could be hard to manage.

Key Factors Influencing Retirement Savings

Several key factors affect your retirement savings. These factors will influence how much money you will have when you retire.

First, your annual income is the base of your savings plan. If you earn more, you can save more, as long as you keep saving regularly.

Next, the rate of return on your investments is very important. Higher rates of return can help your savings grow faster. But remember, with higher returns, there can be more ups and downs. You need to find a good balance between risk and reward.

The savings plan you choose also matters. Plans from employers, like 401(k)s, can give you tax benefits. They may also match the contributions you make, which helps your savings grow even more. Furthermore, spreading your investments across different asset types can lower risk and improve returns over time.

Using Retirement Calculators Effectively

Retirement calculators are helpful tools that can show how ready you are for retirement. You just need to enter details like your age, income, and the lifestyle you want in retirement.

These calculators will give you estimates that can help you plan your finances. While they can’t give you certain answers about the future, they are good guides. They can point out if you might have too little or too much in your retirement savings plan, helping you make any changes you need to.

How Retirement Calculators Work

Retirement calculators use formulas to help you figure out how much money you will need when you stop working. They look at things like your current age, the age you plan to retire, how long you are expected to live, and how much money you may get from your retirement account and social security income.

These calculators also make guesses about how much your investments will grow and how inflation might affect your money over time. Some retirement calculators include a social security calculator, which helps you find out how much social security you might receive based on your work history and what you may earn in the future.

By putting these details together, retirement calculators estimate how your savings will grow and how much retirement income you’ll likely get. This information helps you see how ready you are financially and allows you to make changes if needed.

Interpreting Calculator Results for Future Planning

When you use retirement calculators, remember that they give estimates. These estimates depend on the data you input and some assumptions. Use these results to guide you in your retirement savings plan. They should not be the only thing that decides your financial choices.

Think about getting help from a trusted financial advisor. A financial advisor can look at your risk tolerance. He can help you make better investment decisions. He can also suggest changes to your retirement plan based on your specific needs.

Using a retirement calculator is not a one-time task. It’s important to check and update your information regularly. Changes in your life, like salary increases or new jobs, can impact your retirement planning. So, be sure to look at your financial projections again if such changes happen.

Essential Components of Retirement Savings

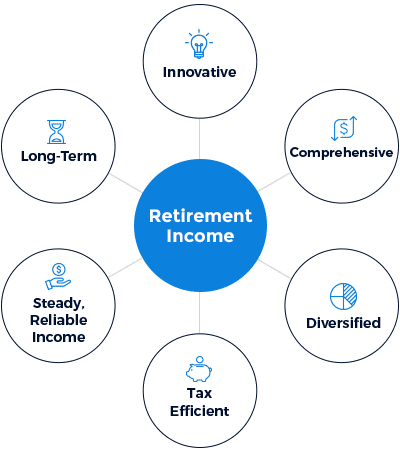

To create a strong retirement plan, you need to use different saving and investment options well. Each option has its own features and benefits. Together, they help you prepare for a secure financial future in retirement.

It is important to know how each part works. This knowledge helps you build a complete plan that matches your comfort with risk and your long-term financial goals. Let’s take a closer look at these important parts.

The Role of Social Security in Retirement

Social Security is a federal program. It is important for many Americans’ retirement income. It gets its funds from payroll taxes. Social Security gives retirement benefits, disability income, and survivor benefits to qualified individuals and their families.

Social Security income usually covers only part of what you earned before retirement. So, it is key to know how it fits into your retirement plan. The amount you receive is based on your earnings history and when you start to claim your benefits.

To get an estimate of your future Social Security benefits, use the online tools from the Social Security Administration. You can also talk to a financial advisor for help. To get the most out of your benefits, timing matters. Think about when you want to start receiving the payments.

Private Savings: 401(k)s and IRAs

Social security, retirement plans, and personal savings like 401(k)s and IRAs are key for a good financial situation during retirement. When you use a retirement calculator, think about the rates of return on your investments. This will help make sure your nest egg is enough for your retirement goals. It’s important to also think about taxes and inflation. This way, you can estimate your retirement income more accurately. Talking to a financial advisor can help you make the best choices for your savings and work towards a secure retirement.

Other Income Sources: Pensions and Investments

Pensions used to be a main way for many workers to get money when they retired, but they are less common now. If you have a pension from your job, it is important to know what it includes and how it can help you plan for retirement.

Besides traditional retirement accounts, looking into other ways to invest can help you earn more money after you stop working. You might think about real estate, stocks that pay dividends, and annuities. These options can help make your investment mix better and provide you with steady income.

Before you decide where to invest your money, think about how much risk you can handle, how long you plan to invest, and what your financial goals are. Talking to a financial advisor can help you make sure your choices fit your needs for retirement income and future plans.

Strategies for Maximizing Your Retirement Savings

Maximizing your retirement savings takes time. It is important to be proactive and stay on track. When you use good strategies in your financial plan, you can improve your chances of reaching your retirement goals. This helps ensure you have a comfortable future.

Here are some strategies to help you get the most from your savings efforts:

The Benefits of Starting Early

Time is your best friend when it comes to saving for retirement. If you start early, even with small amounts, it can greatly help your nest egg grow over time. This happens because of compounding. It means you earn money on your investments and gain interest as time passes.

The longer your money stays invested, the more it can grow. This compounding effect can create significant wealth over the years. If you wait to start saving, you miss out on this important time, which may mean you need to save more later to reach your retirement goals.

Keep in mind that saving for retirement is a long journey, not a quick race. By starting early and saving consistently, you can create a strong financial base for your retirement years.

Tips for Catching Up if You’re Starting Late

If you are starting to save for retirement later than you wanted, don’t worry! While it’s nice to begin early, it’s never too late to take charge of your money and create a retirement plan to meet your saving goals.

One good idea is to use catch-up contributions. If you are 50 or older, this lets you put extra money into your retirement accounts each year. Doing this can help you save more money as you get closer to retirement. By adding the most you can, you will fill in any gaps in your savings.

Also, think about changing your retirement plan to work longer. Working just a few more years can really help your retirement savings. This means you can keep adding money to your accounts. You could also get higher Social Security benefits and have less time for your savings to last during retirement.

Conclusion

Planning for retirement is very important for your financial future. By knowing the key factors that affect retirement savings and using retirement calculators well, you can take steps towards a comfortable retirement. This could mean putting more money into your 401(k) or IRA. You can also think about other income sources, like pensions and investments. Starting early makes a big difference. Social Security is also important in retirement, but it may not be enough on its own. It is a good idea to stay informed and get advice from a professional to help you make smart choices. Remember, your retirement is a journey. With good planning, you can create a future that is financially stable.