Retirement Planning in Spring Hill, TN That Gives You Confidence

Thinking about retirement can bring up a lot of questions. Are you saving enough? When should you claim Social Security? What will healthcare cost? Through focused retirement planning in Spring Hill, TN, we help you get clear answers to those questions and more.

Your retirement should reflect the life you want to live, not just a number in a savings account. With retirement planning in Spring Hill, TN, we help you map out income strategies, consider tax implications, and prepare for both expected and unexpected changes. Our goal is to help you retire on your terms, feeling secure, prepared, and ready.

A Financial Advisor in Spring Hill Who Stays with You

The path to retirement doesn’t stop the day you leave work. That’s why having an experienced financial advisor in Spring Hill, TN can be so valuable. At Goldstone Financial Group, we walk with you through every phase, from planning and transitioning to maintaining your lifestyle in retirement.

Your retirement advisor in Spring Hill, TN will be there to adjust your strategy as your goals evolve. We’ll help you manage your investment, evaluate risks, and make informed decisions as your needs change. Our approach is collaborative and built around long-term support, not one-time advice.

A Complete Range of Financial Planning For Spring Hill Residents

At Goldstone, we do more than just retirement planning in Spring Hill, TN. We provide a full suite of services designed to support you through life’s milestones. No matter where you’re starting from, our team is ready to help you move forward with clarity and direction.

Our services include:

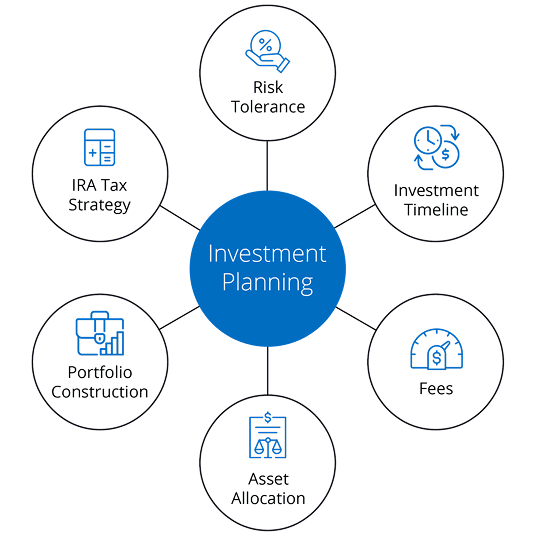

- Investment strategy and portfolio management

- Retirement income planning and distribution strategies

- Insurance reviews and risk analysis

- Legacy and estate planning

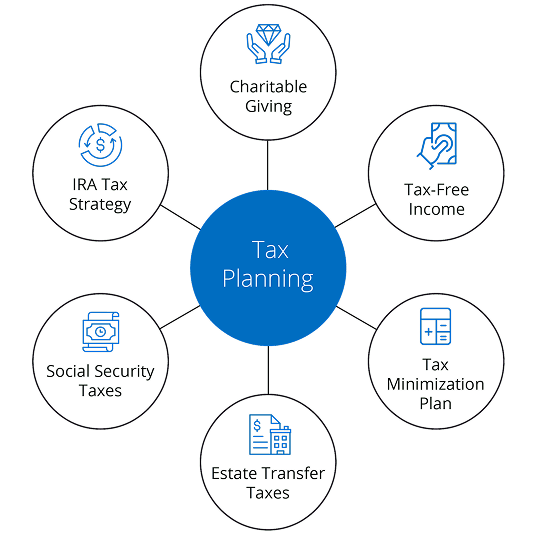

- Tax-smart financial strategies

- Business planning and transition support

Working with a financial planner in Spring Hill, TN means having access to experience, tools, and education that can help you make smart decisions and stay on track.

Secure Your Financial Future Right Here in Spring Hill

Your financial goals are too important to leave to chance. At Goldstone Financial Group, we’re here to help you plan with purpose and move forward with confidence. Whether you’re looking to build wealth, protect your assets, or prepare for retirement, we’re ready to help.

Connect with a retirement advisor in Spring Hill, TN today and discover what it’s like to have a financial partner who puts your needs first.