Retirement planning services are essential for individuals nearing or in retirement to ensure they have a reliable income stream throughout their golden years. These services consider various sources of income, such as Social Security benefits, investment risk, and growth potential, to create a plan that meets each individual’s unique needs and goals. We’ll help you explore the importance of retirement income planning, the benefits of guaranteed income, and how working with a financial professional can help you achieve your financial goals. By working with a retirement planner and considering all sources of income, individuals can create a reliable income stream that allows them to enjoy their retirement years without financial worries.

Guaranteed income is an essential aspect of retirement planning. It provides a reliable income stream that will continue for the rest of your life, regardless of market fluctuations. There are various sources of guaranteed income, such as annuities and pension plans, that can help ensure you have enough money to cover essential expenses throughout your retirement.

Our retirement income planning services consider all sources of income to create a reliable income stream. It’s crucial to evaluate all sources of income and create a diversified portfolio to ensure that you have enough money to cover your essential expenses throughout retirement. There are several sources of income available in retirement, including social security benefits, pensions, annuities, and personal savings. Below we’ve listed a few of the most common sources of guaranteed income.

Other sources of income can include investments, rental income, employer-sponsored retirement plans, and other assets. To find out how to best accommodate your sources of income to have a solid understanding of your income in retirement, contact one of our fiduciary retirement planners by clicking the button below.

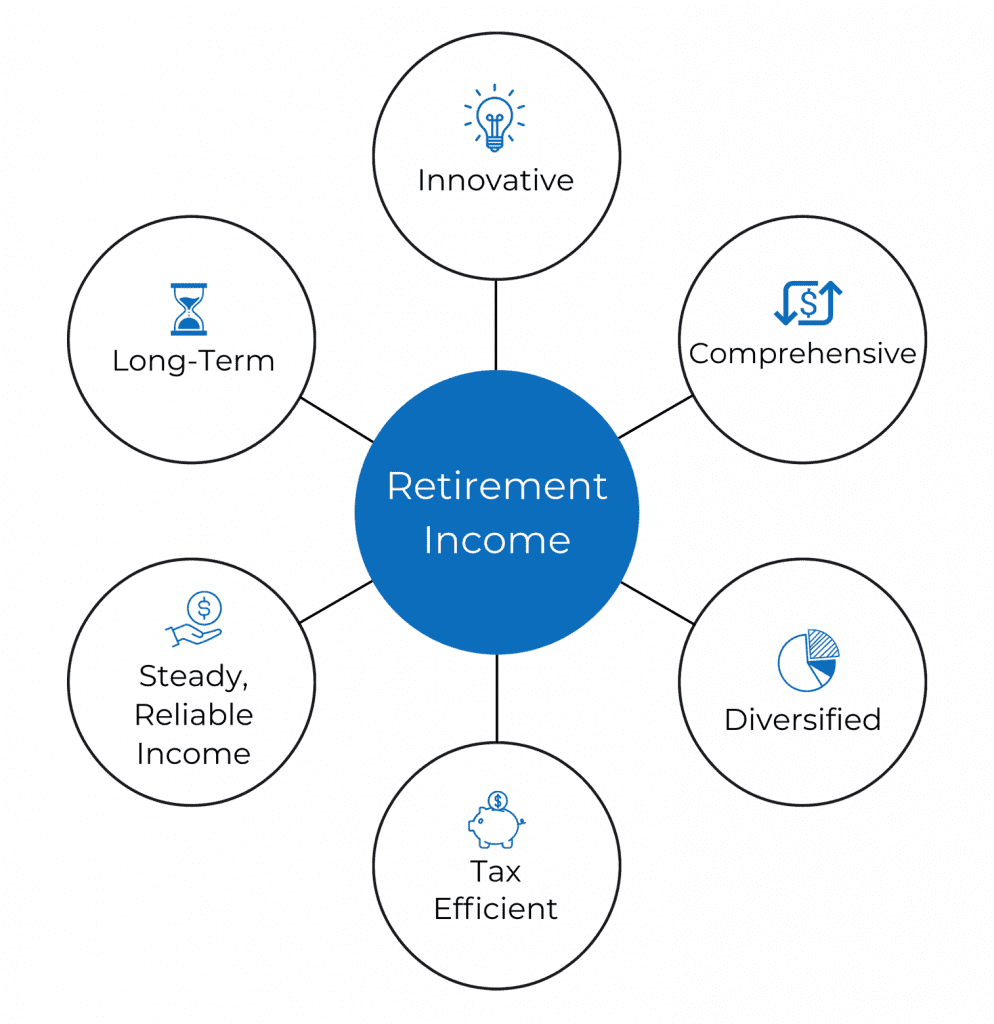

Income planning is the process of developing a comprehensive plan to generate a steady stream of income in retirement.

The key elements of income planning include understanding income streams, maximizing social security benefits, diversifying sources of income, managing essential expenses, and tax planning.

Guaranteed income is a form of income that is guaranteed to last for a specified period or for the rest of your life.

Multiple income streams provide a more diversified and reliable source of income, reducing the risk of financial instability in retirement.

Website Powered by WGA Global & Simple SEO Group

Investment Advisory Services offered through Goldstone Financial Group, LLC a Registered Investment Advisor (GFG). Advisory services are only offered to clients or prospective clients where GFG and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns and investing involves risk and possible loss of principal capital. No advice may be rendered by GFG unless a client service agreement is in place. Services will only be provided in states where GFG is registered or may be exempt from registration. Registration does not imply any level of skill or training.

*Guarantees provided by insurance products are backed by the claims paying ability of the issuing carrier.

“The Changing Story of Retirement” report is provided for informational purposes only. It is not intended to provide tax or legal advice. By requesting this report you may be provided with information regarding the purchase of insurance and investment products in the future.

* Goldstone Financial Group utilizes third-party marketing firms to secure media and publication appearances. Features and appearances may be marketing paid for by Goldstone direct to the media channels and publications listed above. The network and publication appearances listed do not represent any endorsement, level of expertise, recommendation, or any affiliation with Goldstone Financial Group.

Goldstone applied and paid an application fee to be considered for the Inc. 5000 Fastest Growing Companies. The award results were independently evaluated and determined by the Inc. 5000 criteria. Additional information regarding the Inc. 5000 program and full eligibility criteria can be found here.

Goldstone pays an annual fee to be part of the BBB Accreditation Program. The ratings/grades given to Goldstone are independently determined and provided by the BBB and their criteria standards. Additional information regarding the BBB and full details of its Accreditation Standards can be found here.

Goldstone was certified as a ‘Great Place to Work’ in March 2023 after a two-step process including anonymous employee surveys and a questionnaire regarding our workforce. A subscription fee was paid by Goldstone to access the survey website, but no fee was paid to receive the certification. Additional information regarding the Best Places to Work Award and the complete eligibility criteria can be found here.

"*" indicates required fields